How to Best use Your Farm’s Advisors

Are you struggling to grow your farm while managing the day-to-day pressures of running a business? You’re not alone.

Many farm owners face the same challenges, and the right advisors can help guide you to success.

As an alternative lender in the agricultural space, I understand that access to capital and financial advice is essential for farm businesses. One critical factor in ensuring farm success is effectively leveraging the right advisors.

The best farm advisor is a neutral third party who does not have a personal stake in your business. Advisors can help you navigate financial uncertainty, optimize farm operations, and position your business to qualify for important funding opportunities.

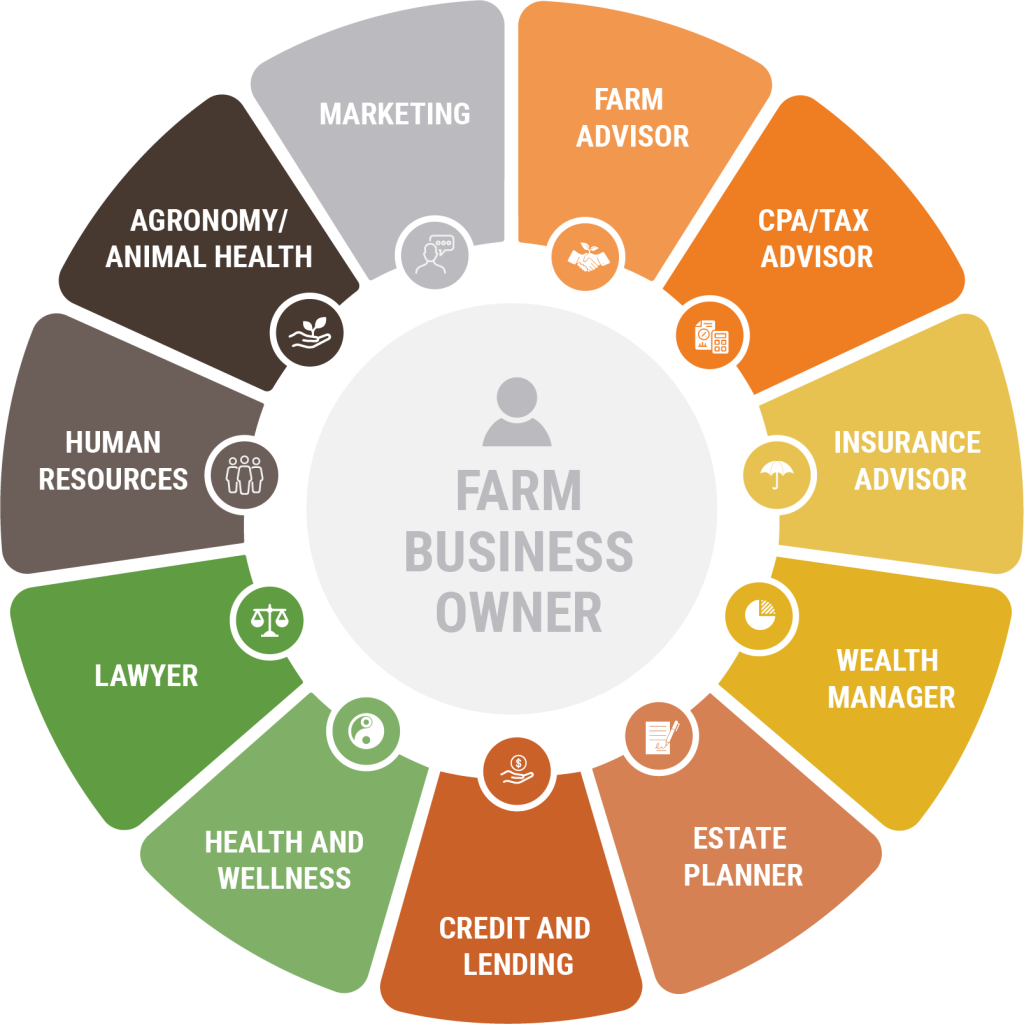

The diagram below highlights advisors a farm business could engage with.

As a business owner, you are enthusiastic about what you do, or at least we hope you are! You should also have a vision for what success looks like for you, for your business and for the others involved directly or supporting you in that success. You are not expected to know it all! BUT you should know what you do not know and bring in expert advisors to help you.

How Should You Choose a Farm Advisor1?

Choosing the right advisor can make or break your ability to secure the necessary funding or investment to grow your farm. For example, advisors who specialize in financial management can help you understand the types of financing available, including non-traditional lending options, which may be key to your farm’s future success.

Here are a few questions to help you choose the right farm advisor.

- Do they have the expertise and specialization you are seeking?

- Do they have the credentials and reputation to support their expertise and specialization?

- Do they have the right experience?

- Do they have a communication style that works with you? Are you compatible?

1For the purposes of the next three steps, a farm advisor is not to be confused with members of an advisory board.

How to Use a Farm Advisor Effectively?

If you’re seeking alternative lending options, a knowledgeable advisor can help align your financial strategy with loan eligibility requirements and help you secure the capital you need.

- Be clear about your goals.

- Provide the advisor with accurate information about your current situation.

- Engage in regular discussion.

- Seek a long-term partnership or until it does not make sense anymore.

What to Do with the Information Your Advisor Provides?

By bringing in specialized advisors, farm owners can make better financial decisions, access new funding opportunities, and ultimately build more sustainable, profitable businesses.

- Assess and prioritize.

- Implement the advice that has been prioritized.

- Monitor and adjust as required.

- By having documented advice, you’ll be better positioned to communicate your farm’s potential to lenders, which will streamline the process when it comes to implementing the plan.

- Seek second opinions if needed.

A clear ten-year vision with one and three year goals and a documented quarterly implementation plan will bring you the most success. As a Certified Management Consultant (CMC) and alternative lending advisor myself, I can provide better information, ask better questions, and provide relevant advice when I have clarity around the farmer’s vision. – Josée Lemoine